This is as a outcome of exchanges typically have lots of users who’re all trying to purchase or promote at the similar time. If an change didn’t have an identical engine that might handle this excessive site visitors quantity, it would shortly turn into overwhelmed and unable to perform correctly. In the past, trading and order matching have been heavily based mostly on phone calls and handbook processes.

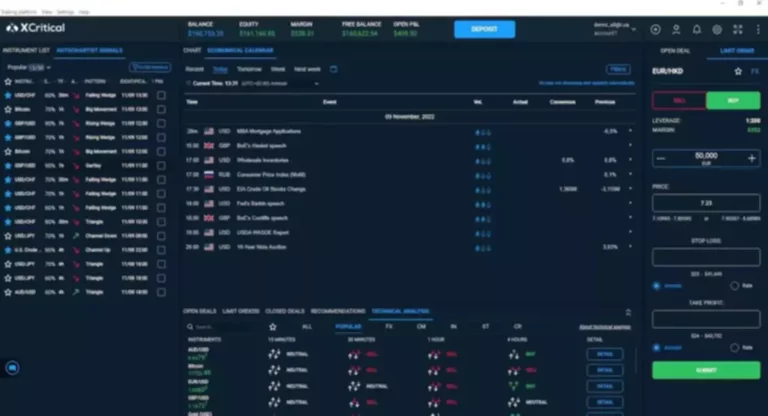

This software program should allow easy visualization of actions on the change and embrace controls like a kill switch to cancel orders or mass cancel features. Every time a trade is made, the steadiness between the most effective available buy/sell prices and volumes thereof is altered as liquidity is eliminated, thus setting a model new prevailing market price. Their purpose is to create a level enjoying field on which market individuals can access value information to purchase and promote securities. The willingness of traders to purchase or promote an asset at a predefined volume and value is logged by these venues, forming public “order books” for each tradable image. Integration – Match engine platforms or software program ought to have the ability to be seamlessly built-in with different technology varieties, guaranteeing the sleek and efficient performance of your buying and selling platform. Order management – A buying and selling match engine aids in order management by offering numerous tools, processes, and algorithms for environment friendly order management.

Complementary Providers From Our Experts

Such methods had been considerably extra time-consuming and susceptible to human error when in comparability with the sophisticated matching engine techniques we use today. Ultimately, the selection between building and buying is determined by numerous elements, including business necessities, obtainable sources, time constraints, and the trade-off between control and convenience. A strong trading platform is constructed around an efficient orders allocation algorithm also called an identical engine. Because this algorithm capabilities because the core of any change, we want to develop one that matches and upholds our values. This is why since day one, we now have been focused on growing a good and highly effective matching engine. These providers may or may not be offered by the organisation that gives the order matching system.

- A centralized engine will be the better possibility when you need your orders to be matched rapidly.

- Minimize disruptions to buying and selling and meet the demands of modern 24×7 markets and regulatory requirements.

- We’ve already mentioned the order guide, which is likely certainly one of the major elements of a matching engine.

- A host of add-on integrations, customized growth work, and help services from our trading and know-how experts ship complete front-to-back capabilities.

- Exchanges and marketplaces present a venue for market gamers to swap shares, digital currencies, commodities, and different investment choices.

Although matching engines are sometimes missed, they stand as a testament to the precision and sophistication underlying modern trading platforms. A matching engine is the unseen force ensuring that the gears of the market turn easily, providing traders with the ability to transact with pace, fairness, and efficiency. When choosing a matching engine, it’s necessary to consider the system’s speed, security, and charges. Centralized engines are sometimes quicker and more environment friendly but additionally have larger charges.

Pro-rata algorithm fills orders according to price, order lot measurement and time. An incoming order from a market participant is evenly split amongst matching counter orders proportionally to their dimension. The most used algorithm is time/price priority, generally referred to as First In First Out (FIFO).It will give the priority to the oldest counter order that matches at the most effective https://www.xcritical.in/ out there value. The remaining orders will turn into the “order book” for the next order obtained by the matching engine. The Console UI software within DXmatch provides a user-friendly interface for monitoring and administering orders on an change.

Connamara’s Discovery process provides detailed pricing and steerage that matches the exchanges tailor-made needs. This modular licensing structure means you solely pay for the particular functionality and integrations your change requires, resulting in a more efficient and cost-effective path to market. EP3 normal order matching features a price-time precedence algorithm however is extensible to other matching algorithms. By leveraging modern technologies like kubernetes, Kafka, and MongoDB, the EP3 matching engine can respond quickly to will increase in market activity. EP3’s matching engine expertise can maintain an order fee as excessive as one hundred twenty,000 orders per second at a sub-8 microsecond common latency.

Managed Publish Commerce Services

This is considered one of the hottest order matching rulesets during which orders are matched according to their worth and the time they have been positioned. Also known as FIFO (first in, first out), the oldest order at a particular worth level shall be prioritized in this ruleset over newer orders on the same value. The bid and ask prices on the e-book are gotten from the previous market costs. A transaction router hyperlinks the market participants who submit orders and obtain orders. When an order is sent to the router, it submits it to the queue to be fulfilled as both a market, restrict, or cancel.

EP3’s built-in market surveillance tools cut back complexity by enabling you to trim the number of third-party tools related to your platform. EP3 is resilient, mechanically redistributing order circulate throughout remaining engines if one matching engine fails, ensuring fixed availability. EP3 is self-healing, so if one matching engine throughout the trade fails, order circulate is mechanically rebalanced across the remaining engines to make sure availability. Minimize disruptions to buying and selling and meet the calls for of modern 24×7 markets and regulatory requirements. Advanced options, conceived by capital markets consultants, ensure EP3 is scalable, reliable, and resilient.

The order matching system is paramount in each change for its efficient execution of trades and ensuring that every one transactions are fulfilled at the best price. Marksman Hub resolution which aggregates cryptocurrency exchanges corresponding to B2BX, non-bank liquidity providers and 1000’s of orders from institutional shoppers culminating within the industry’s deepest liquidity pool. Electronic cash institutions dealing in bank deposits, digital fund transfer, fee processors and cryptocurrency depend on an automated matching engine to facilitate electronic transactions. EP3 could be deployed quickly and simply to cloud, hybrid-cloud, and on-premises environments with using fashionable orchestration and containerization methods.

What’s A Repair Api, And How Can You Use It In Trading?

These options make DXmatch a robust and reliable choice for buying and selling venues and exchanges looking for an environment friendly and high-performance order matching engine. The first thing that involves mind when talking about software is pace and efficiency. Surely, the liquidity of an change additionally impacts buying and selling pace and effectivity. However, a commerce matching engine allows high-frequency trading utilizing a fancy algorithm system. A trade matching engine is the core software program and hardware part of any electronic change, and all different trade techniques are peripheral to the match engine since no market can exist without it.

B2Trader Matching Engine aggregates users orders into order books on a particular platform on all property obtainable that don’t generate extra fees for routing outdoors sources. You can appeal to reliable market makers to create a strong liquidity pool in your exchange by way of powerful REST and WebSocket API. An superior interface which fulfills all requirements from

In contrast, a decentralized engine, reliant on a peer-to-peer community, may exhibit slower efficiency. Traders enter their intentions to purchase or promote, recording them in the order guide. This is the place the matching engine steps in, analyzing the landscape and connecting appropriate orders. Let us present you ways our superior exchange platform and matching engine can propel your organization to the front of the buying and selling race. Let us show you the way our advanced exchange platform and matching engine propel your group to the front of the trading race.

In this article, we will take a extra in-depth look at how matching engines work and explore some out there differing types. Another necessary issue to consider when choosing a matching engine is the system’s security. Centralized engines are sometimes more vulnerable to assaults than decentralized engines. This is as a result of they depend on a central server that could be focused by attackers. Decentralized engines, however, are extra resilient to attacks as a result of they use a peer-to-peer community. Matching engines are used in numerous change platforms, together with stock exchanges, Forex exchanges, and cryptocurrency exchanges.

DXmatch is a modular platform geared up with advanced threat administration options. These include value slippage limits, built-in fat finger safety, kill swap, self-trade prevention, message throttling, min/max quantity validation and min/max value validation. The features safeguard your clients and shield your corporation including worth to your clients and ensuring that your corporation stays protected even in worst-case scenarios. DXmatch is Devexperts’ proprietary order matching engine designed for ultra-low latency and high throughput purposes. It is trusted by regulated securities exchanges, darkish swimming pools, cryptocurrency exchanges, and OTC venues worldwide. In different words, the matching engine is what permits all of the above to happen, leading to the creation of environment friendly world markets on which huge amounts of liquidity can change palms each day.

Benefits And Drawbacks Of Utilizing Matching Engine Software Program

An order matching engine eliminates the risk that any of the parties involved will default on the transaction. A matching engine can partially fulfill an order or not meet it at all in the case of a limit order. Memory – Memory aids so as recovery in case of a crash, so ensure your match engine software has memory and an inbuilt restoration mechanism. Latency – This issue is crucial for companies, especially these deploying high-frequency buying and selling methods. The First-In-First-Out (FIFO) algorithm, also referred to as the Price-Time algorithm, gives priority to buy orders based mostly on value and time.

A set of strategies and instruments for resisting or mitigating the impact of DDoS attacks on networks. Stops the potential for manipulating the markets by putting and cancelling faux orders. FOK (Fill or Kill) order because the time in pressure causes the whole order to be fully crypto exchange engine executed instantly or cancelled. Effectively construct and manage affiliate campaigns for an impressive software that may draw prospects. All limit orders are aggregated in the order e-book with the power

The Market Data Feed service offers the power to obtain real-time updates concerning the trading info such as quotes, final traded price, volumes and others. Common usages of this API embody web-based buying and selling systems (widgets like Watchlist or Market Depth) and public web sites. DXmatch enables the execution of multi-leg buying and selling methods allowing customers to create complex methods inside the engine itself. DXmatch supports buying and selling derivatives permitting buying and selling venues to broaden their choices past cryptocurrencies. This functionality enables the inclusion of spinoff merchandise within the exchange’s portfolio. In our own DXmatch answer, we use clusters of impartial order processing models (replicated state machines), all equal copies of every other in order to keep high availability in a cloud environment.

Experience the top of superior options and performance with the EP3 change platform and order matching engine. With many years of expertise in capital markets, our team has crafted flexible, trader-centric instruments that redefine transparency, enhance liquidity, and optimize price efficiency in exchange trading. Order matching engines are the spine of contemporary monetary markets, facilitating the seamless execution of trades.