VC-backed businesses typically choose to outsource their bookkeeping and tax preparation/compliance to experienced CPA firms. Tax planning is an essential aspect of financial management for startups. Proper accounting practices enable businesses to organise their financial records and transactions in a tax-efficient manner.

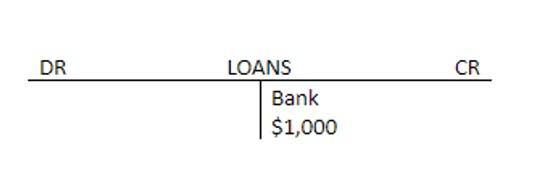

A journal can help you trace the financial history of your business activities over a given period, whether your firm is receiving funds or spending expenses. Making adequate journal entriesYou can create a historical record of all your business transactions by making the appropriate journal entries. There are a few different options available when it comes to accounting and bookkeeping. From customer payments to supplier invoices, it’s important to have a system in place to track all of your financial activity. In short, while startups may not need an accountant in the early days, they will eventually need one if they want to scale and grow their business.

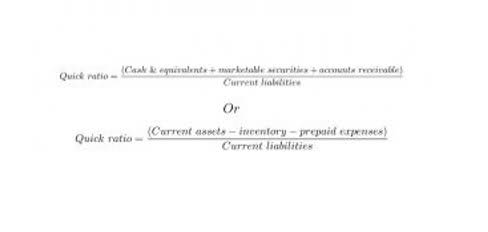

#3: Familiarize yourself with basic financial statements

If you’re going to have employees, you’ll need to have a payroll system. Having payroll in place when you bring on your first hire will help you ensure that they are paid on time and accurately, which will benefit you both. Don’t worry if you don’t know how to set up payroll, you can use our step-by-step guide or sign up for our flexible payroll services. How can you take tax deductions at year-end if you aren’t keeping track of your expenses?

Your accountant can help you decide on the right software solution for your business. Again, the impetus for these funding rounds differs for every business. The common thread among all funding rounds is that the business needs money to reach its next stage of growth. An accountant can help you prepare your books to put your best foot forward for investors. There are many good reasons for the way things work – GAAP (generally accepted accounting principles) has been honed for decades.

Organize your records:

As with many business resources, cloud-based accounting and bookkeeping services are the premier choice for many modern businesses. One principle within GAAP that contributes to guided decision-making is the Principle of Prudence. This principle ensures that accountants present financial information based on concrete facts and avoid speculation.

Whether you hire an accountant or opt for any software that will help you in understanding the basics of startup accounting. Accounting for startups is a challenge because it means extra expenses. accountant for startups For a new startup, this could mean hiring accountants to get the accounting work done. Understanding the accounting procedures could be another big challenge for an entrepreneur.

Why Budget – The First Step in Startup Accounting

Before jumping into the nits and grits of how you can automate accounting for your startup, let’s go over some of the most common accounting terms and concepts you need to know as a startup owner. After all, no matter how great an idea is, it won’t launch without proper financing. The hard truth is that https://www.bookstime.com/ almost 30% of newborn businesses fail due to burning up all their money before breaking even. Typically, the earlier, the better, because you will be set up with the best financial practices from the beginning. Entries will need to be added to the correct account, such as cash, expense, or inventory.

- Tax compliance is a subset of due diligence, and your accountant can help you explain to the VC fund or the acquirer that you have followed all federal and local rules and regulations.

- Although an accountant can’t offer you legal advice, they can tell you what common practices exist in your industry.

- Payroll taxes are taxes that ALL companies with payroll pay – even money losing, early-stage companies.

- After entering your bills in accounts payable, track them weekly to make sure that they’re paid on time.

- An accountant will produce financial documents and set you up with accrual accounting which investors take more seriously when making a startup valuation.